4 altcoins to buy amid heating up markets

The cryptocurrency market is again heating up, led by Bitcoin (BTC), after the flagship digital asset reclaimed the $35,000 mark. As the short-term gains progress, there remains widespread uncertainty regarding the sustainability of the rally, with some market participants anticipating a continuation while others foresee a correction.

With Bitcoin rallying, attention has also turned to altcoins and their ability to emulate the largest cryptocurrency by market capitalization. Notably, several altcoins have been rallying, presenting an opportunity for investors to capitalize on in the future.

In this context, cryptocurrency trader and analyst Michaël van de Poppe, in a YouTube video on November 5, identified the following altcoins to consider buying as the markets heat up.

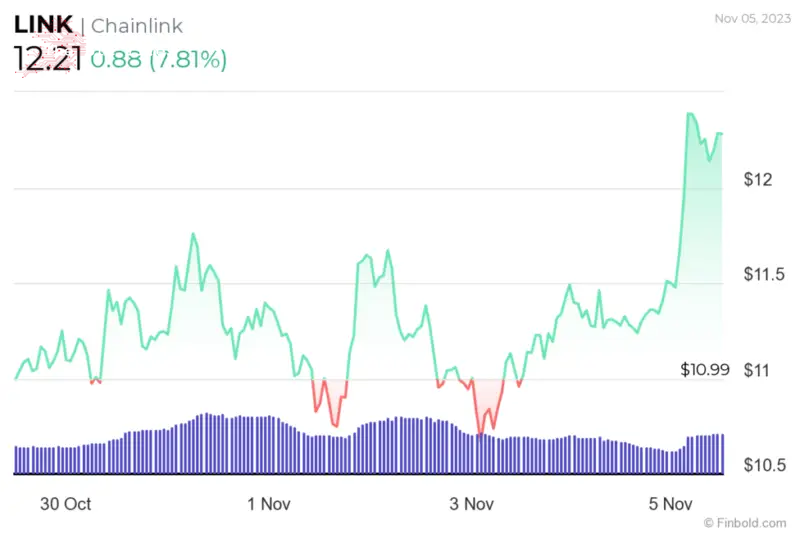

Chainlink (LINK)

Poppe pointed out the need to buy Chainlink (LINK) based on the token’s historical price movement. He emphasized that LINK historically correlates with Bitcoin, meaning the asset classes tend to move together. The analyst noted that LINK indicates a pattern of higher lows and higher highs.

Poppe acknowledged that LINK’s value has already begun surging and identified two key price levels to watch out for that present an ideal buying point. In his view, investors should look for a possible correction around the $9.50 and $10.

In his analysis, Poppe stated that if the current strength in price movement continues, LINK could potentially outperform and reach a price range of $25 to $30.

As of press time, Chainlink was trading at $12.21, gaining over 7% in the last 24 hours. On the weekly chart, Chainlink is up over 11%.

Aave (AAVE)

Aave (AAVE), a prominent player in the DeFi space, is currently at a pivotal moment as its valuation rallies in tandem with the general market. Poppe observed that AAVE has encountered formidable resistance, a barrier that has held for an impressive 542 days.

However, Poppe pointed out that AAVE, which has been accumulating in recent days, is likely on the cusp of a possible breakthrough. If this resistance is successfully breached, it could signal the end of a prolonged accumulation period, potentially propelling the price to levels between $260 and $280, paving the way for further gains in the broader DeFi market.

As of press time, Aave was trading at $91.25 with daily gains of about 0.6%, while on the weekly chart, the token is up 11%.

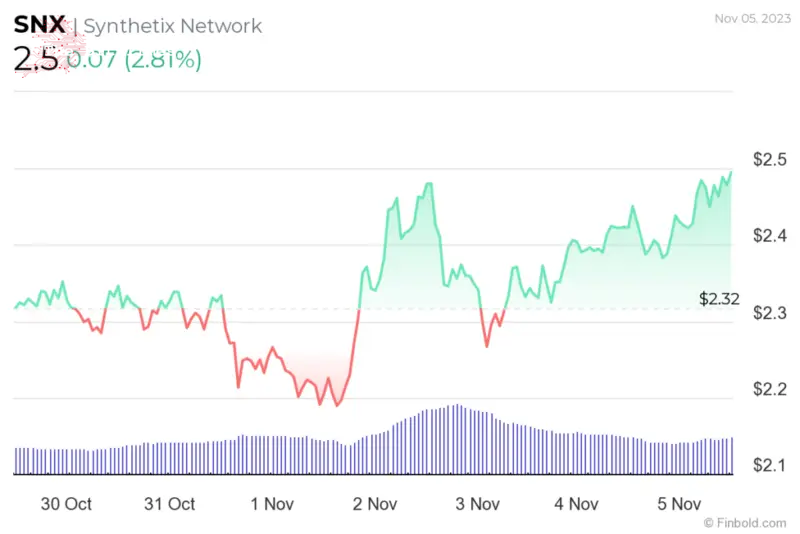

Synthetix (SNX)

The crypto analyst noted that similar movements in Synthetix (SNX) mirror the sentiment around AAVE. The DeFi protocol, providing a platform for creating and trading synthetic assets, is currently contending with a formidable resistance level.

According to Poppe, market sentiment suggests that heavy accumulation and discussions on social media platforms indicate growing interest in Synthetix. Despite prevailing bearish sentiments, he believes that this may signal a turning point for the asset.

In his analysis, Synthetix has been a laggard in recent market movements. However, he contends this could change dramatically if the resistance is successfully breached. In the event of a breakthrough, Synthetix could see a surge in value to a range between $7.50 and $8.

This potential breakout comes after a previous attempt was deemed a “fake out” into resistance, underscoring the importance of precision in timing market entry.

In the past seven days, SNX has risen over 7%, trading at $2.5 by press time.

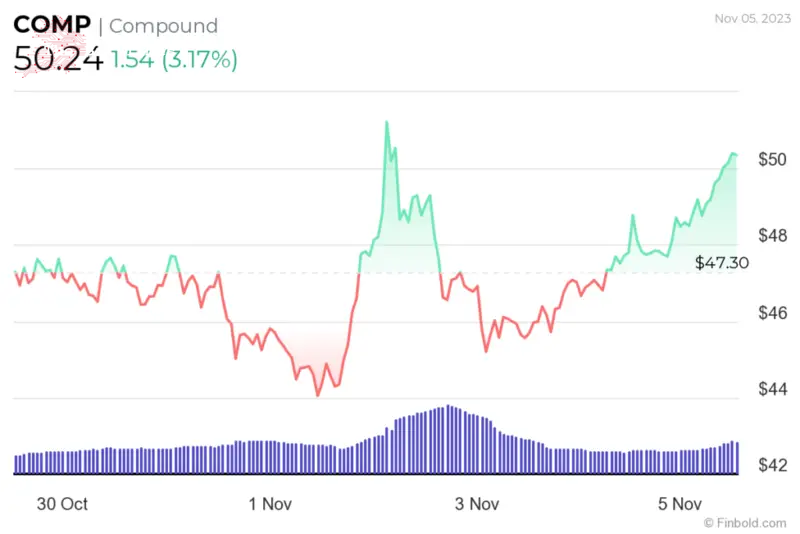

Compound (COMP)

Compound (COMP) is also displaying signs of resurgence, closely mirroring AVE’s trajectory. Like its counterpart, Poppe pointed out that the Compound faces a crucial resistance point.

In this context, the analyst emphasized the importance of monitoring social media channels where substantial accumulation is apparent, even as some participants maintain a bearish outlook. This divergence in sentiment implies that a phase of profit-making opportunities may be underway.

As of press time, COMP was valued at $50.72, reflecting a daily gain of nearly 6%. On the weekly chart, Compound has seen a 7% increase.

In a broader perspective, Poppe suggested that newly emerging altcoins are poised for impressive performance if the current market momentum persists.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment